Think of an insurance policy as a binding agreement between you and the insurance company. It’s their way of assuring you that they’ll provide coverage for any particular financial risk you may encounter. For this coverage, you will need to pay a premium, and the coverage will be provided for a set period of time. Given the various financial risks you encounter, there are specific insurance plans available to provide coverage for these risks. It’s important to be well-informed about these types of plans in order to make the best decision when purchasing a policy that meets your coverage needs.

In general, individual insurance plans can be divided into two main categories: life insurance and general insurance. Life insurance primarily provides coverage for the possibility of death occurring before expected. General insurance, on the other hand, encompasses a wide range of plans that fall into various categories. Now, let’s delve into the most prevalent insurance policies found on the market.

Life insurance

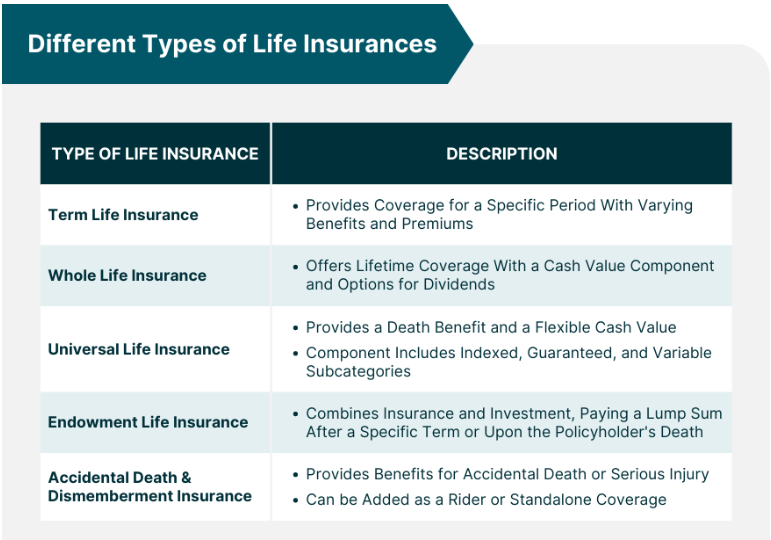

As previously stated, life insurance is a form of insurance that provides coverage for the potential of early death. When purchasing a life insurance policy, you are provided with coverage for a set period of time. If unfortunate circumstances occur and you pass away during the policy’s duration, a death benefit will be paid out. There are various categories of life insurance plans, which include:

Insurance coverage that is not specific to any particular industry or sector.

Within the general insurance category, you will find a variety of commonly available plans:

Health insurance

Health insurance plans provide coverage for the financial expenses related to a medical emergency. Indemnity-oriented medical insurance plans cover the medical costs of hospitalization. There are individual health insurance plans that provide coverage for one person, and family insurance plans that extend coverage to all family members under a single policy. In addition, there are specific plans available for senior citizens.

Fixed-benefit health insurance plans offer a set benefit amount regardless of your medical expenses. Some common examples of these plans are critical illness health plans and hospital cash plans. Health insurance plans are available from both private companies and government-owned providers.

Car insurance

Car insurance plans encompass both car insurance and two-wheeler insurance plans. Having valid third-party liability cover is a requirement under the Motor Vehicles Act, 1988, for all vehicles in India. Therefore, it is essential to have motor insurance plans for your vehicles. These plans provide coverage for any financial responsibility resulting from bodily injury, death, or property damage caused by your vehicle. If you choose comprehensive motor insurance plans, your vehicle’s damages will also be covered.

Travel insurance.

Travel insurance plans provide coverage for the financial losses that may occur during your travels. Travel insurance plans typically provide coverage for a range of common situations, such as emergency medical expenses, loss or delay of baggage, loss of passport, accidental death or disablement, and more.

Insurance for your home

A home insurance policy provides coverage for the financial loss incurred when your home and/or its contents are damaged as a result of natural or man-made disasters. If your house were to experience a fire or theft, a home insurance policy would provide coverage for the resulting loss.

Which option is the most suitable for your needs?

When it comes to insurance plans, it’s important to select the ones that are essential for you. Having a life insurance policy is essential for ensuring your family’s financial security in the event of your absence. It is advisable to consider investing in a high-quality life insurance plan. If you’re trying to determine the most suitable life insurance policy from the various options, the decision ultimately hinges on your specific requirements.

Having a term insurance policy is essential for ensuring financial security. If you have children and want to create a secure corpus for them, you can consider opting for a child plan. Just like a financial analyst, you can consider pension plans to help you plan for your retirement. It’s important to familiarize yourself with various life insurance plans before making a decision on which ones are most suitable for you.

In addition to life insurance, it is essential to have a health insurance policy to cover the high medical expenses that may arise during a medical emergency. Then, if you have a vehicle, a motor insurance policy would be required. Travel insurance plans can be beneficial when preparing for a trip, while a home insurance policy provides an extra level of protection for your residence.

So, in summary, it would be wise to consider purchasing both a life insurance and health insurance plan, and then select any additional plans based on your specific coverage requirements.